Chicago - United States of America

**To be connected to "WHY THIS PROPERTY" on the new Dashboard property page**.

Neighbourhood: Jeffrey Manor

Jeffery Manor is part of the Chicago South Side and is an atypical Chicago neighborhood because the curving street layout differs from the rest of Chicago. This quirky street pattern gives Jeffery Manor a unique character that its residents are endeared to. Jeffrey Manors is a suburban area with extra space, green areas, trees and backyards.

Chicago

Voted by Conde Nast as the best city in the US for the ninth year in a row, Chicago, with its vast green spaces and world-renowned architecture, is now taking the culinary world by storm with multiple world class restaurants as diverse as the city itself. Centrally located in the US, its airport hub at Midway is fueling the cities renaissance and growth.

Chicago is the third-largest city in the U.S., right behind New York and Los Angeles, a major world financial center and home to the second-largest central business district in the U.S. Key industry sectors in Chicago include business and professional services, food industry, transportation, and logistics, life sciences and healthcare, technology, and manufacturing. Much of the Housing Stock in Chicago was built prior to World War II, making it one of the older and more historic cities in the country. The architecture of Chicago has influenced the history of American architecture and Chicago’s buildings in a variety of styles by many important architects. The Median Home value is expected to increase by 4.36% by the end of this year. The rent increased by 6.8% over the last year, following an increase of 13.4% in 2 years. Inventory of properties for sale was reduced by 18.5% over the last 12 months.

Your rental returns are paid monthly in USD

After renting out the property, returns are distributed to investors based on their shares. Rental income is transferred monthly in dollars directly to your digital wallet in your Investor Dashboard:

Once received, you can transfer your funds to your bank account or reinvest them in another property: the choice is yours.

One of the great advantages of our platform is that you can track your earnings with total transparency and in real-time.

Create your Bricksave account now and explore all the options we offer you in your Investor Dashboard.

Partial rent guarantee through the Section 8 program

The rent payments for this property are guaranteed between 70% and 100% by the United States federal government's Section 8 program.

It ensures steady payments, providing a predictable cash flow and significantly reducing risks in this investment.

See more information about the Section 8 program, and how it helps to guarantee rent payments.

The property will be professionally refurbished

The property will undergo meticulous renovation by our local experts, which will enhance its value and functionality.

Renovation costs are fully included in the purchase price, as well as in the estimated returns. Moreover, the company will cover maintenance expenses, incorporating these into the total estimated cost, reflected in the price.

Bricksave will manage the entire renovation process, leveraging experience gained from hundreds of previous projects.

Maintenance costs included in the estimated returns

Bricksave's local and global management teams oversee all properties to ensure property maintenance is as efficient as possible.

At Bricksave, we commit to making real estate investment as transparent and predictable as possible. A key part of this promise is including maintenance costs within the purchase price of each property. This means investors don't have to worry about unexpected maintenance expenses post-purchase.

This all-inclusive approach ensures that projected returns are realistic and reflect the property's true income potential, offering a safer and more reliable investment experience.

Reduction of risks associated with traditional real estate investment

The comprehensive management of properties by the Bricksave team ensures optimized performance and maintenance, further reducing risks associated with traditional real estate investment. Leveraging technology has significantly minimized these risks, and we aim to continue proving this.

Insurances play a crucial role in covering potential property damage and protecting against unexpected losses. Combined with detailed market analysis, these tools significantly lower investment risk for investors.

Real estate crowdfunding also allows for diversification, enabling investors to spread their capital across multiple properties and markets.

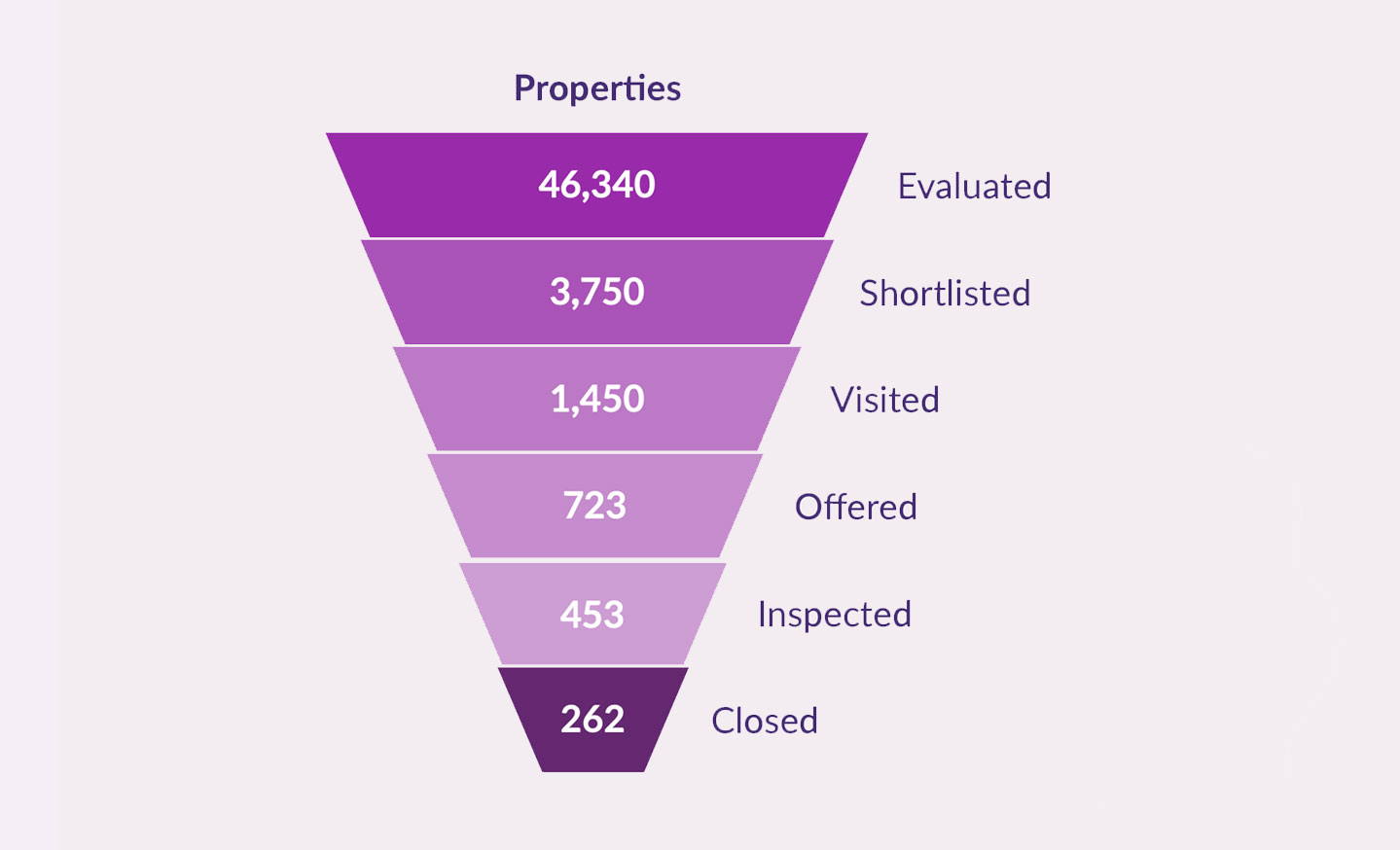

This property has passed our thorough selection process

Annually, our team evaluates around 20,000 properties, and only about 1% are approved. From location to legal aspects, this property has undergone a rigorous analysis.

This graph, based on 6 months of data, shows the selection process this property has gone through:

The property selection process includes these 6 steps:

1. Location analysis

Evaluation of the top 100 population centers and analysis of macroeconomic and real estate market data.

2. Market analysis

Study of 3,000 data points, including demographics, crime, employment, education, and more.

3. Rental analysis

Evaluation of rental potential based on monthly rental data.

4. Site analysis

In-person review of properties and neighbourhoods by local partners.

5. Legal Due Diligence

Legal research on the property to identify potential complications.

6. Structural inspection

Detailed inspection of the property's condition and maintenance needs.

This process ensures the property has been rigorously evaluated. Visit this page for more details on our due diligence process.

2-year investment term

This investment is characterized by a shorter term to provide greater liquidity and flexibility, aiding investors in diversifying their portfolio and reducing exposure to potentially less favourable market trends.

Here are its advantages compared to a 4-year term:

1. Quick access to invested funds

You can recover your money more quickly.

2. Ease of changing plans

It's easier to shift your investments if the market changes.

3. Reduced risk of property price changes

There's a lesser chance of losing money if property prices decline in the long term.

4. Capitalising on better interest rates

You can secure better loan or reinvestment terms more frequently.

5. Quick adaptation to new opportunities

You can move quickly if other investment options emerge.

6. Faster money-making

It's beneficial if you're looking for earnings in a shorter time frame.

7. Not tying up your money for too long

You don't have to lock in your money for an extended period, giving you more options to invest in other things.

See more about the investment terms we offer and their benefits.

4-year investment term

This investment term is ideal if you want your money to grow over time without needing it soon. Here are some reasons to consider a 4-year investment term:

1. Increase in property value

More time likely leads to an increase in value, potentially yielding more profit after 4 years.

2. Steady rental income

The property will be rented out, providing regular cash flow and stable income throughout the investment term.

3. Less concern about market fluctuations

Over 4 years, short-term market changes will impact less, offering peace of mind through temporary downturns.

4. Easier financial planning

Knowing your investment is secure for 4 years allows for clearer and unhurried personal financial planning.

5. Opportunities to improve the property

Ample time for enhancements could significantly increase the property's value by the time you decide to sell.

6. Ease of management

Ideal if you prefer not to frequently reinvest or seek new opportunities.

7. Benefits of a fixed interest rate:

Securing a loan for the property with a fixed interest rate for 4 years protects against interest rate increases.

Learn more about the benefits of 2-year and 4-year investment terms for real estate investors.

Legal and administrative aspects fully managed

Bricksave has an expert team in real estate law and administration, ensuring that everything is handled in accordance with current laws and regulations.

We take care of all legal and administrative tasks throughout the duration of this investment:

1. Due Diligence Process

Verification of the legality of the transactions and properties involved.

2. Regulatory Compliance

Ensuring that all operations comply with applicable local and international regulations and laws.

3. Contract Management

Drafting and managing investment contracts and agreements with investors.

4. Property management

Maintenance and daily operations of funded properties.

7. Yield management

Distribution of rental income and benefits among investors.

8. Permits and licenses

Obtaining the necessary licenses and permits to operate properties.

9. Insurance

Acquisition and management of insurance to protect investments and properties.

10. Contract compliance

Ensuring that all parties involved comply with the terms of contracts and agreements.

11. Reports and documentation

Generation of financial reports and necessary documentation to inform investors.

12. Financial planning

Budget management and finances related to investments.

By handling all of these details, Bricksave reduces the risks associated with traditional real estate investment.

XXX Investors have already chosen this area

The choice of XXX investors in this area through Bricksave reflects a well-established confidence in the market. By joining this investment community, you benefit from a market that has already been tested and is preferred by many.

Investors receive proof of ownership of this investment

Each investor will receive a certificate of ownership and a participation certificate, confirming their ownership percentage in each project. This approach ensures transparency and clarity regarding each investor's participation.

Furthermore, each investment is protected by ownership interests, whether direct or indirect, in the underlying real estate. This guarantee provides an additional layer of security, as investors have a tangible and direct connection to the physical asset they are investing in.

Investment secured by equity interests

This investment is secured by direct or indirect equity interests in the underlying real estate.

Before acquiring the property, investors' contributions are held in escrow until Bricksave has raised enough capital to complete the purchase of the property. This ensures that your investment is always secured by the underlying asset you are investing in.

Details on how these investments are handled and protected are provided in the specific documents for each investment.

Crowdfunding property

You benefit from the advantages of purchasing this crowdfunding property alongside other investors, such as:

More affordable investment

You can start investing from USD 1,000.

Exclusive access

It allows you to access real estate projects that may be out of your reach individually.

Access to diverse markets

With a lower entry price, you can diversify and reduce risks by investing in other properties.

Learn more about the benefits of investing in a crowdfunding property.

Entire property

Investing in a property as the sole owner also has its unique benefits:

Greater control

As the sole owner, you have complete control over decisions related to the property, including management, improvements, and rental strategy.

Full benefits

You receive 100% of the rental income and any appreciation in the property's value.

Simplicity in Ownership Structure

Individual ownership eliminates the need to coordinate with other investors, simplifying the ownership structure.

Long-term stability

Sole ownership offers a tangible and stable investment that can be part of a long-term strategy.

Savings on subsequent investments

By owning an LLC exclusively, you save XXX on any other investment you decide to make with Bricksave.

View the latest real estate investment opportunities from around the world.

Login or register to view full portfolio of properties available

Investing carries risks, including loss of capital and illiquidity. Please read our Risk Warning before investing.